The Best Strategy To Use For Estate Planning Attorney

The Best Strategy To Use For Estate Planning Attorney

Blog Article

All about Estate Planning Attorney

Table of ContentsEstate Planning Attorney Things To Know Before You BuyThe Estate Planning Attorney PDFsGetting The Estate Planning Attorney To Work9 Easy Facts About Estate Planning Attorney DescribedWhat Does Estate Planning Attorney Mean?

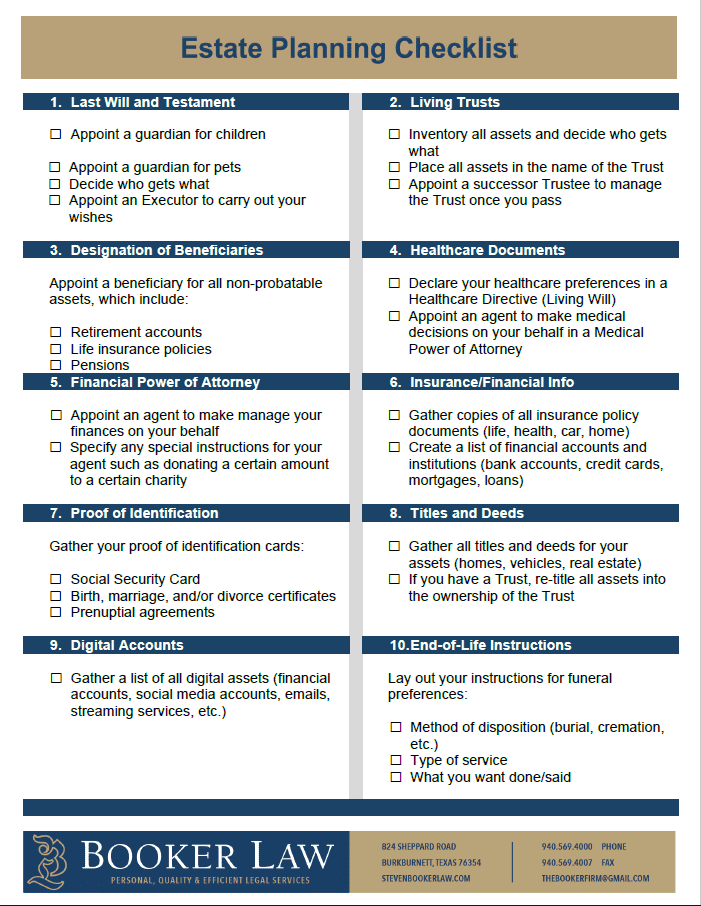

A skilled attorney that understands all elements of estate preparation can help make certain clients' wishes are performed according to their intentions. With the ideal guidance from a reliable estate organizer, individuals can feel great that their plan has been created with due care and interest to information. As such, people need to invest sufficient time in locating the appropriate lawyer that can use audio guidance throughout the entire process of establishing an estate strategy.The documents and guidelines created throughout the planning process become legally binding upon the customer's fatality. A professional economic consultant, based on the desires of the deceased, will after that start to distribute count on assets according to the customer's guidelines. It is vital to keep in mind that for an estate strategy to be effective, it needs to be properly implemented after the client's fatality.

The designated executor or trustee need to guarantee that all assets are managed according to legal needs and in accordance with the deceased's wishes. This commonly includes accumulating all paperwork related to accounts, financial investments, tax documents, and other products defined by the estate strategy. Furthermore, the administrator or trustee may require to coordinate with lenders and beneficiaries associated with the distribution of assets and various other matters concerning working out the estate.

In such circumstances, it might be needed for a court to interfere and solve any type of conflicts before final circulations are made from an estate. Eventually, all elements of an estate need to be cleared up successfully and precisely based on existing regulations to ensure that all events involved receive their reasonable share as planned by their enjoyed one's wishes.

The Definitive Guide for Estate Planning Attorney

People require to plainly understand all aspects of their estate strategy prior to it is instated (Estate Planning Attorney). Dealing with a seasoned estate preparation lawyer can assist make sure the papers are properly drafted, and all expectations are met. Additionally, an attorney can provide understanding right into exactly how different lawful devices can be used to shield assets and take full advantage of the transfer of riches from one generation to one more

Estate planning refers to the prep work of tasks that manage an individual's financial scenario in case of their incapacitation or fatality - Estate Planning Attorney. This preparation consists of the bequest of possessions to beneficiaries and the settlement of estate taxes and financial obligations, together with other considerations like the guardianship of minor youngsters and pet dogs

Several of the actions consist of detailing properties and financial obligations, examining accounts, and composing a will. Estate intending tasks include making a will, establishing trusts, making philanthropic contributions to limit inheritance tax, calling an administrator and beneficiaries, and setting up funeral setups. A will certainly provides instructions about residential property and protection of minor children.

Some Known Facts About Estate Planning Attorney.

Estate planning can and must be used by everyonenot just the ultra-wealthy. Estate preparation involves establishing exactly how a person's assets will be maintained, handled, and dispersed after death. It likewise considers the management of an individual's residential or commercial properties and financial responsibilities in case they come to be incapacitated. Properties that can compose an estate consist of houses, automobiles, supplies, art, collectibles, life insurance policy (Estate Planning Attorney), pension plans, debt, and a lot more.

Anyone canand shouldconsider estate planning. Writing a will is one of the most important steps.

Review your retirement accounts. This is essential, especially for accounts that have recipients affixed to them. Bear in mind, any kind of accounts with a recipient pass straight to them. 5. Evaluation your insurance coverage and annuities. Make sure your beneficiary details is current and all of your various other info is precise. 6. Establish joint accounts or transfer of fatality classifications.

A Biased View of Estate Planning Attorney

8. Create your will. Wills do not simply unwind any type of monetary uncertainty, they can also lay out prepare for your small kids and pet dogs, and you can likewise instruct your estate to make philanthropic contributions with the funds you leave. 9. Evaluation your files. Make sure you look over everything every pair of years and make adjustments whenever you choose.

Send out a copy of your will to your manager. This makes sure there is no second-guessing that a will exists or that it obtains lost. Send out one to the person who will certainly assume duty for your affairs after you pass away and maintain another duplicate somewhere secure. 11. See a monetary specialist.

The Best Guide To Estate Planning Attorney

There are tax-advantaged financial investment cars you can make their website use of to aid you and others, such as 529 university financial savings intends for your grandchildren. A will is a lawful document that offers guidelines regarding exactly how an individual's home and protection of minor children (if any type of) need to be dealt with after fatality.

Report this page